ALDI has been one of the most successful and aggressive international players in the Australian retail scene since its arrival in 2001. In that time it has opened 305 stores and is currently experiencing sales growth of almost 7%. Not surprisingly then, plenty more stores are planned as the German giant moves south and west from its established position in the eastern states.

While many ALDI stores are stand-alone operations, they are increasingly being found in Australian shopping centres. This facilitates ALDI’s expansion in some markets, and provides landlords with an additional or alternative supermarket anchor that has strong consumer recognition and appeal.

It is also important to remember that ALDI stores are packaged in a smaller footprint than either Coles or Woolworths’ preferred models.

According to Directional Insights’ 2013 Consumer Shopping Benchmarks (for centres that have ALDI as a tenant) 19% of customers visit ALDI whilst in centre.

Though when considering ALDI as a possible tenant, what data would you draw on? There is no freely accessible data profiling ALDI customers, and while we always recommend site specific research, it can be handy to have some figures to work with before you take this step. As such, we’ve analysed over 1,000 shoppers in Australian shopping centres who visited an ALDI store whilst in centre to give you some information about the ALDI customer.

Firstly, some demographics: ALDI customers are more likely to be female, have a lower than average household income and an older average age. There is a strong representation amongst consumers over the age of 60 who are attracted to ALDI’s value offer.

Further, in terms of transport, 90% of ALDI customers travel to the centre by car, and on average they are more likely to be travelling from the secondary trade area.

For ALDI customers, the two largest Lifestage groups in terms of both expenditure and visitation are Young Families and Older Couples, with 35% of ALDI customers being over 60 years of age and 26% retired.

So is ALDI right for your centre? They are small and so easy to fit in. They will generate foot traffic, have a very high conversion rate of visitation to expenditure, and have a broad appeal (although at the lower to mid-level of the market).

And of course it depends on the type and positioning of your centre. With restrictive planning legislation being lifted in Victoria, and being touted in other states, ALDI is being canvassed as a potential addition in Homemaker and Large Format Retail centres. But at the end of the day, how would an ALDI fit into your specific centre?

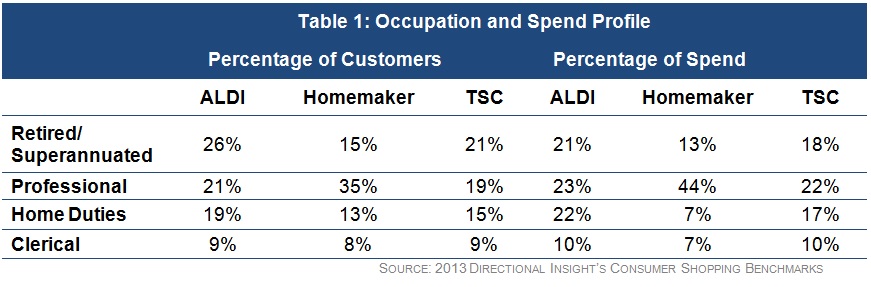

Well, the dominant occupations and roles of ALDI customers are Retiree/ Superannuants, Professionals and those engaged in Home Duties. Professionals make up 21% of ALDI customers: while this is a lot lower than the 35% they account for in Homemaker centres, it is in line with figures for Traditional Shopping Centres (TSCs).

As Table 1 shows, Retirees/ Superannuants and Home Duties customers together account for 43% of expenditure in ALDI, compared with 20% in Homemaker centres and 36% in TSCs. Professionals on the other hand account for nearly half the spend at Homemaker centres.

This is not to say there is no place for ALDI in Homemaker centres – there are strong arguments for broadening the customer base and improving trading activity across a full-week, and consumers have been spontaneously suggesting supermarket additions to the Homemaker centres we’ve been conducting surveys in .

There are many different types of Homemaker and Traditional centres positioned at different levels in the market. This study indicates that customer profiles, behaviour and needs should be thoroughly investigated before committing to a particular supermarket model in a homemaker centre.

If you would like more information about our research into ALDI customers, or our shopper profiles for Homemaker centres, please feel free to contact us at info@directional.com.au